26+ Total debt to income ratio

The debt-to-income ratio DTI is a metric used by lenders to determine how much debt a company can afford. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

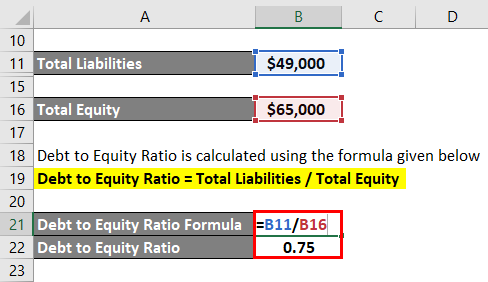

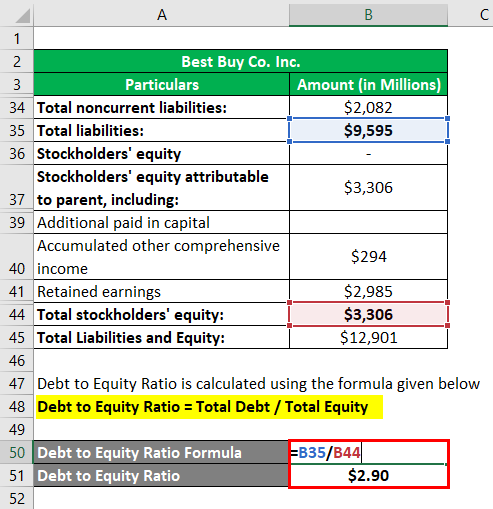

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Lenders assess a persons debt-to-income ratio when considering loan.

. Your debt-to-income ratio is between 29 and 42 which means that your risk is considered average by most lenders. For example lets say you pay 1000 for your mortgage 500 for your car and. Debt to Income Ratio 5500 2440 443.

Add up your monthly bills which may include. To calculate it simply add up all of your debt. Although you have an.

The DTI guidelines for FHA. The 43 rule is a debt-to-income ratio that is used to determine who qualifies for a loan and who does not. To calculate your DTI ratio total all monthly debts and divide the.

The debt-to-income ratio is derived by dividing monthly debt payments by monthly gross income before taxes. Your debt-to-income ratio measures your monthly debt obligations in comparison to your monthly gross income or the amount of money you earn before taxes. Monthly alimony or child support payments.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. It is calculated by dividing the total amount of monthly debt. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax.

In this formula total monthly debt payments represent. Its a quick way to learn if you earn enough each month to confidently cover the bills. Called DTI for short your debt-to-income ratio is the percentage of your gross monthly income that goes toward debt payments.

Student auto and other monthly loan payments. Total Monthly Obligations 2440. Monthly rent or house payment.

To this point the Consumer Financial Protection Bureau defined debt-to-income ratio as the total of monthly debt payments divided by gross monthly income. Later use the Build a Budget tool to see how you can maximize your current earnings. Proposed monthly property taxes insurance and HOA fees 475.

Debt to income ratio is the percentage of your total amount of monthly debt payments over your total amount of gross monthly income before taxes and deductions are. If they had no debt thei See more. As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48.

Back-end 29 to 42. Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio. A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the.

Rebecca Lake Oct 26 2021. For instance if you pay 2000 a month for a mortgage 300 a month for an auto loan and 700 a month for your credit card balance you have a total monthly debt of 3000. Finally divide your total monthly debt payments by your monthly income to find out your DTI.

Your front-end or household ratio would be 1800 7000 026 or 26.

Debt Ratio Bookkeeping Business Financial Ratio Debt Ratio

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

1 Stop Mortgage First Time Home Buyers Real Estate Values Debt Ratio

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Income Ratio Formula Calculator Excel Template

Ex 99 2

Debt Coverage Ratio Example And Importance Of Debt Coverage Ratio

What Percentage Of Your Income For Mortgage Moneyunder30 Mortgage Payment Mortgage Payoff Mortgage

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

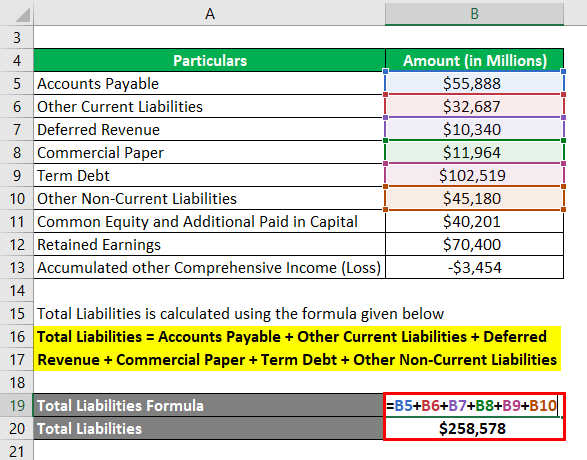

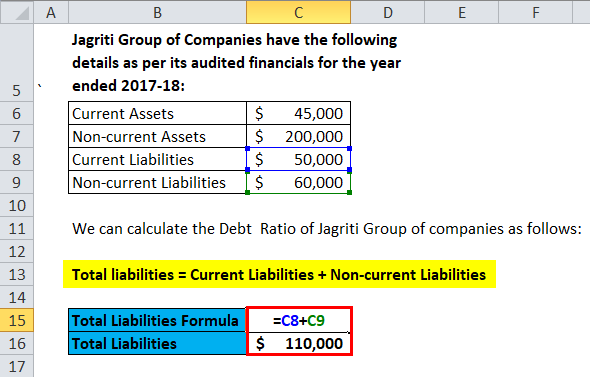

Debt Ratio Formula Calculator With Excel Template

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Mortgage Payment

How To Calculate Loan To Value Ratio Topic 11 Bankingtutorial Learn Banking With Easy Tips Youtube

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Pin On Free Printables

Debt To Capital Ratio Formula Meaning Example And Interpretation Debt Raising Capital College Adventures

Debt Ratio Formula Calculator With Excel Template